SITUATION

• A strategic review of IT architecture identified a gap in Bath Building Society’s enterprise workflow capability

• Needed to streamline operations, including mortgage applications and payments

RESULTS

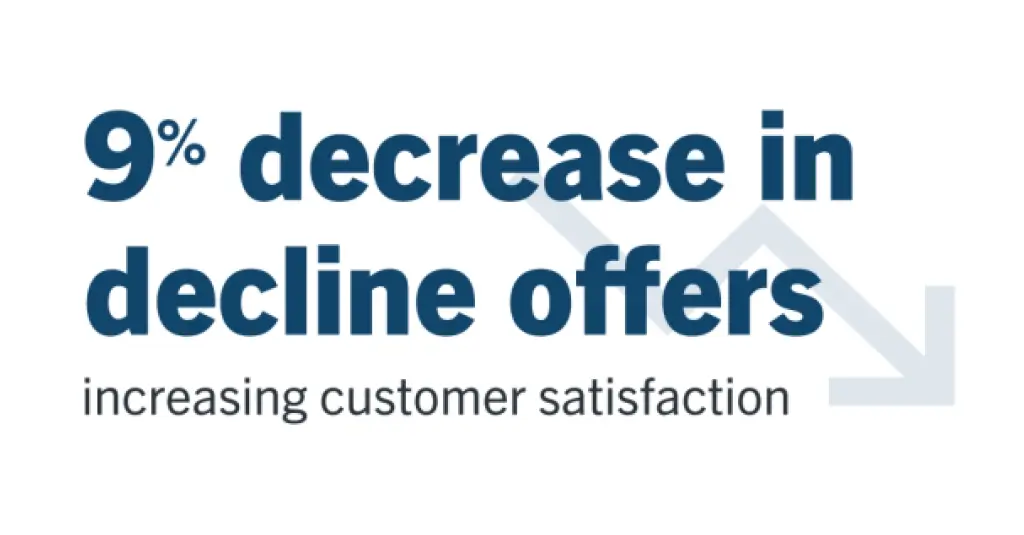

• Used Laserfiche Cloud to create dynamic digital forms that cut down time and effort for customers and intermediary mortgage brokers

• Enhanced data quality and decision-making for the Society’s employees

• Improved service quality

• 30% more efficient mortgage process for applicants, brokers and the Society

Bath Building Society’s purpose is to help its members achieve their financial goals of buying a home and saving for the future. That motivation also drives the constant improvement of the customer experience, as members are at the heart of every initiative.

Today, the Society is using digitisation and automation to deliver faster services for members more efficiently. Laserfiche has been an important tool for the organisation, and now acts as both a centralised information hub and workflow engine that accelerates how work gets done while simplifying and standardising processes, without adding additional compliance burden. Instead, Laserfiche has allowed the Society to automate much of the manual tasks, reclaiming time for employees to focus on

service and growth.

“We must comply with the same regulations as larger lenders with compliance teams way bigger than our whole Society head count,” said Steve Burnard, chief transformation officer at Bath Building Society. “We have to have compliance by design. This approach enables us to save time because the systems and processes we now use will automatically ensure compliance.”

An Investment in Automation

Bath Building Society had already been using Laserfiche as a data repository for over 10 years when in 2022, the organisation performed a strategic review of its entire IT architecture. The assessment revealed a gap in the Society’s enterprise workflow capability, which led the Society on a search for a system that could create scalability through automation. At the same time, the Society needed to simplify compliance with regulatory requirements with tools such as audit trails and records retention schedules.

The procurement process led the Society to Laserfiche Cloud, in part due to a strong existing relationship with MBS — the leading Laserfiche solution provider in Europe with expertise in the financial services industry — in addition to the robust workflow automation and compliance capabilities of the Laserfiche platform.

“In a highly regulated market, we particularly appreciated the ‘compliance by design’ aspect — that we would be able to build in data retention policies and automate those processes around information management,” said Burnard. “That was a huge benefit. It meant that we didn’t need to then spend time resource on retrospectively applying those rule sets.”

Modernising Mortgage Application

One of the most significant areas in which Bath Building Society implemented Laserfiche is mortgage processing. The organisation replaced a paper and PDF-driven decision in principle (DIP) application process with a dynamic Laserfiche form and automated workflow that captures the necessary information digitally, and automatically routes it to the relevant sales team members to make a decision.

The legacy process involved a 100-question paper form — common in the industry — that was not only unwieldy to the applicant but also to the Society staff. Using Laserfiche, the team transformed the application into a dynamic, digital questioning tool which only asked the applicant relevant questions based on the details that the applicant provided.

“It saves the end customer time, while improving the quality of the responses, because they’re spending more time on the questions that are relevant,” Burnard said. “It also then gives us the information to power better decision and data points which then leads to better decision-making.”

The business has subsequently rolled this tool out into the full mortgage application journey. Now with Laserfiche, instead of having to complete the same 100 questions again, plus filling in the additional information needed for this section of the process, applicants can take what they have previously done and apply it to the new form.

The process has enormous time saving benefits for Bath Building Society’s employees and their brokers. Previously dependent on email, the legacy process required employees to manually name folders and files, while now that’s all done for them, along with the application of retention dates for simplified compliance. This has enabled applicants to complete the process more accurately in 30% less time, helping them secure the mortgage they desire more rapidly and with less effort.

“Certainly, in the mortgage space, speed is really important,” Burnard said. “Improving that speed gives a compact customer experience, and then for the end customer — the person who borrows the money — we’re making it quicker for them at the very start of the process. They’ll be happier with quicker turnaround times, quicker responses.

“It enhances the experience for the customer, and it makes it easier to do business; that’s ultimately a barrier in our industry,” Burnard added. “We hope start to chip away at that by having a more intuitive, digital form.”

Simplifying Payments and Savings

On the savings side of the business, Bath Building Society has plans to use Laserfiche’s workflow capability to shift tasks around the individual teams while keeping request forms and necessary evidence all in one place. External payments once required a time-intensive and manually driven approval process, which resulted in additional manual effort and delays, which could be frustrating for both applicants and the Society’s staff.

Using the same Laserfiche functionality in dynamic forms and workflows, the Society built a standardised questionnaire that enables employees to simply check the boxes that need to be checked and attach evidence to the form which is automatically routed to the group of employees with the relevant mandate.

Employees across the Society were sending around 200 emails per day on this one process alone. With Laserfiche, they have reduced that to just a handful of emails to the relevant people.

“It’s a huge culture shift with clear accountability,” Burnard said. “It reduces the time it takes because all the information is in one place, and it reduces complexity because it’s only going to the team that needs to take action. We have an audit trail — it’s faster, simpler and more compliant.”

The Future of the Building Society Experience

Bath Building Society has expanded its use of Laserfiche to other areas of the business, including human resources for new employee onboarding, but the demand for Laserfiche solution is growing across the organisation.

On the horizon, Burnard hopes to build an even more comprehensive mortgage process, enabling applicants to go from the online mortgage affordability calculator straight into an application without having to re-enter the information they have submitted for the calculator.

“We’re not looking to reduce headcount and replace people with optimised forms,” Burnard explained. “What we are looking to do is create and improve scalability. The old approach was calculating how many mortgages could be processed by one person. We’re looking at the system to do that scalability for us and improve our operational capacity through the use of these forms.”

Meanwhile, innovative technologies create more sustainability for the business as well, with younger employees expecting a streamlined, modern experience. “Old systems are unintegrated, visually unappealing,” Burnard said. “Laserfiche Cloud is a much more visually appeasing system to use. It’s much more intuitive, and it’s what colleagues expect to see when it comes to workplace technology.

“At an industry level, simplification is really important,” Burnard added. “As a building society, we operate in a highly competitive, service-focused market, so anything that makes it easier for customers and brokers to secure a mortgage rapidly and efficiently is critical for us to compete and grow. We don’t employ software developers in-house and probably never will, so being able to leverage technology with our partners like MBS is fundamental to survival.”